Why are States Making Retirement Plans Mandatory?

These new state laws aim to ensure that every working individual has access to a retirement plan in order to ensure financial stability in the future. A study cited by Plan Adviser found that only 34% of small businesses currently offer retirement savings plans to their employees. This leaves a substantial portion of the American workforce without access to employer-sponsored retirement savings options. As a result, state governments are stepping in to give every employee an opportunity to save for retirement.

Related Reading: 2024 Update on State-Mandated Retirement Plans

What is the Hawaii Retirement Savings Program

The Hawaii Retirement Savings Program (HRSP) is a bill that aims to establish a state-facilitated individual retirement plan for private sector employees in Hawaii who do not have access to employer-sponsored retirement savings plans. Proposed to start July 1, 2024, employers will need to automatically enroll their employees into the program, although employees have the option to opt out. Here are some key points from the bill that small business owners in Hawaii should be aware of:

1. State-Facilitated Payroll Deduction Plan

The Hawaii Retirement Savings Program operates as a payroll deduction retirement savings plan, where employers are required to automatically enroll their employees into the program if they do not offer a company-sponsored retirement plan. However, employees have the choice to opt-out if they wish.

2. Type of Account & Contribution Amount

The Hawaii Retirement Savings Program will be offering Roth IRA accounts, which means employees pay taxes on money going into their account, and then all future withdrawals are tax-free.

The default contribution amount deducted from an employee's payroll is 5% of their salary or wages. Employees have the flexibility to increase or decrease this amount. The total annual contribution limit for 2024 is $7,000 or $8,000 if over the age of 50.

3. Employer Responsibilities

While employers play a role in enrolling their employees and supporting employee questions, they are not responsible for investment decisions, program administration, or program design. Employers are also not required to make matching contributions for their employees who are enrolled in the program.

4. Potential Penalties

It's important for small business owners to be aware that penalties may be imposed on employers who fail to enroll covered employees or transmit payroll deduction contributions on time. Per the bill, there could be penalties of:

- $25 for each month the covered employee was not enrolled in the program; and

- $50 for each month the covered employee continues to be unenrolled in the program after the date on which a penalty has been assessed; provided that the employee has not opted out of participation in the program.

PS: Did you know there are tax credits available for small businesses that offer a company-sponsored retirement plan? As a small business, you may qualify for a tax credit that covers 100% of your plan start-up costs and employer match. These tax credits can add up to $16,500* and are available for three years. Schedule a complimentary call with our team to learn more.

5. Impact on Small Businesses

The HRSP is particularly relevant to small businesses since many do not offer retirement options for their employees. As a small business owner in Hawaii, you should familiarize yourself with this program to avoid any fees for being non-compliant.

For more details, you can refer to the bill here.

Penelope Retirement Plans for Small Businesses in Hawaii

If you're a small business owner in Hawaii looking to get ahead of the state mandates and avoid any fines, you can set up an affordable retirement plan with Penelope today. We've designed our retirement plans especially with busy business owners in mind. With a simple setup, automatic enrollment, and Vanguard target date funds, saving for retirement has never been more streamlined.

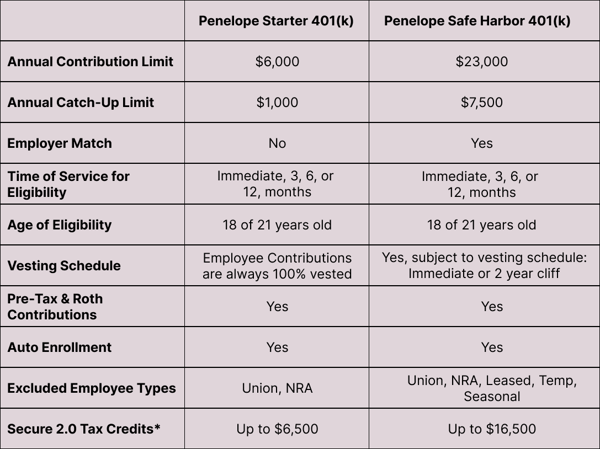

Compare Our Two Retirement Plans:

Why Choose Penelope for Your Small Business Retirement Plan?

- Affordable Pricing: Penelope offers flat-fee subscription plans starting at $49 per month plus $3 per participating employee per month. There are no additional asset-based or transaction fees

- Vanguard Funds: With Penelope, you can focus on your business knowing your money is growing with Vanguard funds for best-in-class performance

- Payroll Integration: Penelope quickly connects with your payroll provider to auto-enroll new hires, update salary changes, and change employment types

- Support and Guidance: Penelope has a dedicated support team for frequently asked questions, plan setup, and onboarding

- Compliance and Recordkeeping: Penelope takes care of compliance testing and annual reporting to the IRS, serving as your digital recordkeeper

- Quick Setup: You can create your business's 401(k) plan in just 15 minutes by providing some basic information about your business

Things to Consider with State-Sponsored Retirement Plans

Below, we outlined some of the challenges you might face with state-sponsored retirement plans. This is not to discourage you, but rather to provide a balanced perspective to help you make an informed decision.

- Lack of Plan Customization: State-sponsored retirement plans often come with a standard set of features and options. This can limit your ability to tailor the plan to meet the specific needs of your business or employees.

- Minimal Customer Support: State-sponsored plans might not provide the same level of customer service and employee support as private sector providers. This could leave you with unanswered questions and unresolved issues.

- Ineligibility for Tax Credits: By choosing a state-sponsored plan, you may miss out on tax credits available to small businesses that set up certain types of retirement plans. These tax credits can help offset the costs of starting and administering the plan.

- Limited Investment Options: State-sponsored plans may offer fewer investment options compared to other retirement plan options. This could limit the diversification and growth potential of your employee's retirement savings.

- Potential for Additional Administrative Burden: While some state-sponsored plans aim to reduce administrative tasks for employers, you might still be responsible for certain duties like facilitating payroll deductions and managing employee enrollment.

Schedule a Complimentary Call With Penelope

When selecting a retirement plan, consider factors such as the size of your business, the administrative capabilities you have, and what you're looking to offer employees. Compare the Hawaii State Retirement Plan to offerings from Penelope’s Retirement Plans, taking into account contribution limits, matching requirements, and costs associated with each.

Schedule a complimentary call with Penelope's retirement specialist to learn more about your retirement plan options.

*Please consult with your accountant for personalized financial advice.