In the absence of any federal laws requiring that employers offer retirement plans, a growing number of states are passing legislation mandating that businesses provide these types of benefits for employees.

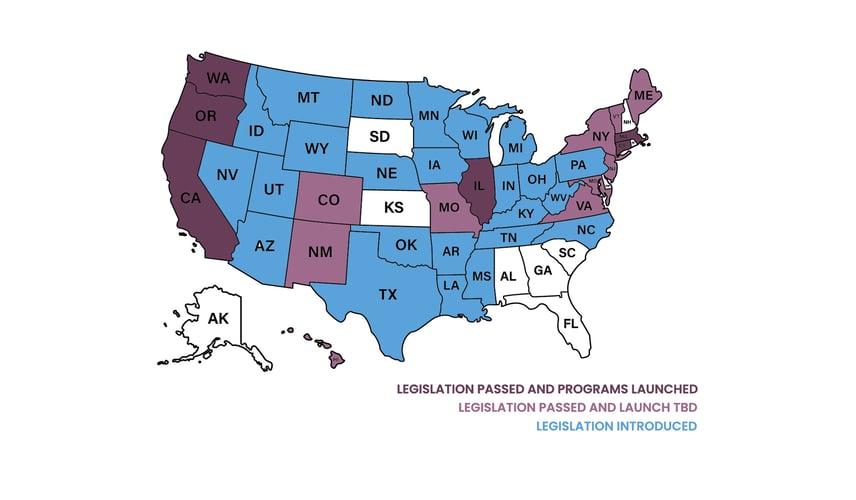

While the number of states that already have such programs in place remains small at 16 states, the good news is that over the past decade, some 47 states have begun working on this issue, either taking steps toward adopting a mandated retirement program or introducing related legislation, which is substantial progress, according to Georgetown University’s McCourt School of Public Policy Center for Retirement Initiatives (CRI).

With these mandates becoming more common, it’s important to understand whether your business is impacted by such requirements and what steps are needed to comply. Here’s a closer look.

What is a State-Mandated Retirement Plan and Who is Impacted?

A state-mandated retirement plan is a retirement savings program that is mandated by the state government for private-sector employees who do not have access to an employer-sponsored retirement plan. These programs are designed to make it easier for small businesses to offer retirement savings options to their employees.

Several states in the U.S have implemented these state-mandated retirement plans, also known as auto-IRA programs. In these programs, employers who do not offer a workplace retirement plan are required to automatically enroll their employees into a Roth Individual Retirement Account (IRA) managed by the state. The employees can then contribute a portion of their paycheck to this account.

Each state's program varies in terms of the specific rules and regulations, but the general idea is to increase retirement savings among workers who may not otherwise have the opportunity to save through an employer-sponsored plan. It's important to note that while these programs are state-mandated, participation for employees is usually voluntary.

Remember that while these plans can offer a solution for some businesses, they might not be the best fit for everyone. Depending on the specifics of your business and your employees' needs, other options like 401(k) plans might be more beneficial. Reach out to our team for a complimentary call if you want to compare your retirement options.

Penalties for Non-Compliance with Your States Mandated Retirement Plans

Equally important to understand as a business owner, states with retirement plan mandates may charge steep penalties for not providing employees with access to a retirement plan.

In California, for instance, the current guidelines stipulate that employers with an average of four or fewer employees will be able to participate and will be required to join CalSavers by December 31, 2025, if they do not sponsor a retirement plan. Employers that fail to do this are subject to a penalty of $250 per eligible employee for the first non-compliance notice and an additional $500 per eligible employee if the non-compliance continues another 180 days or more after notice.

However, penalties and requirements vary by state, so it’s important to do your research and understand the local laws.

Why are States Adopting Retirement Plan Mandates?

There’s a retirement savings crisis in the United States. A report from the Federal Reserve reveals that one in four Americans have no retirement savings. A separate report, this one from the Employee Benefit Research Institute (EBRI), found that the aggregate retirement savings shortfall for all U.S. households ages 35 to 64 as of January 1, 2020, was $3.68 trillion.

State-mandated retirement plans are an attempt to help address these types of troubling statistics. Oregon was the first state in the nation to start enrolling private sector employees in a state-operated retirement plan. The state initiated OregonSaves back in 2017, according to the Pew Charitable Trusts. Some of the other early leaders included California, which initiated CalSavers in 2019, and Illinois, which kicked-off its plan in 2018.

Which States Already Have Retirement Plan Mandates?

The number of states actively considering mandated retirement plans is rapidly growing. Below is an update on which states have mandated retirement plans as of January 2024.

California

Under state legislation, businesses that do not provide a retirement plan of their own must facilitate the CalSavers program. If your business, in the preceding calendar year, employed on average a minimum of five employees based in California, with at least one being 18 years old or more, and does not sponsor a qualified retirement plan, it is obligated to register for CalSavers.

Colorado

In accordance with Colorado law, all businesses that have been operational for a minimum of two years and employ five or more individuals are obligated to facilitate the Colorado SecureSavings program. This mandate applies specifically to those businesses that currently do not offer a qualified retirement plan for their employees.

Connecticut

In Connecticut, state law mandates that employers, regardless of whether they are for profit or not-for-profit, must facilitate the state's retirement savings program, MyCTSavings, under certain conditions. This applies if the employer had five or more employees in Connecticut as of October 1st of the previous calendar year and paid at least five of those employees a minimum of $5,000 in taxable wages in that same year. Furthermore, this requirement is applicable to those employers who currently do not offer a qualified, employer-sponsored retirement savings plan.

Delaware

Under Delaware law, businesses employing more than five employees that do not currently offer a retirement plan are required to participate in the DE EARNS program. The goal of this program is to facilitate retirement savings for their workers and increase access to retirement savings plans. The program is set to be implemented with a proposed launch date of January 1, 2025.

Illinois

The Illinois Secure Choice program is their state-initiated retirement savings plan designed for employees within the state. It is mandatory for employers who have five or more employees in Illinois and do not already offer a retirement plan, to either introduce one or enroll in the Illinois Secure Choice program.

Maryland

Under Maryland law, most employers are required to offer some sort of retirement savings to their employees. This can either be a traditional pension or through the MarylandSaves program. The MarylandSaves program requires workers to be at least 18 years old to participate. Importantly, it is intended for those who do not have access to an employer-sponsored retirement plan.

Massachusetts

The Massachusetts state-mandated retirement plan is the Massachusetts Defined Contribution CORE Plan. This 401(k) program has been designed specifically for non-profit organizations with 20 employees or less. It offers both tax-deferred and post-tax savings options. The CORE Plan is developed to provide a retirement savings solution for employees of eligible small non-profit organizations that might not have access to employer-sponsored retirement plans.

New York

New York's state-mandated retirement plan is known as the New York State Secure Choice Savings Program (SCSP). This program is still under development but if you are a business owner in New York, be aware that a state mandate is underway.

Nevada

Nevada's state-mandated retirement plan is known as the Nevada Employee Savings Trust. This program was created under Senate Bill No. 305 and passed into law in June 2023. The law mandates that employers who don't currently offer retirement plans must register their employees in the Nevada Employee Savings Trust Program or an equivalent program provided by a trade association or chamber of commerce. Businesses with a staff of more than five and have been operating for a minimum of 36 months are obliged to provide access to this program or a comparable one to their employees. As of now, the program will be up and running by July 2025 and accepting contributions.

Oregon

The Oregon state-mandated retirement plan is known as OregonSaves. This program is designed to provide an easy and automatic way for Oregonians to save for their future. Launched as a pilot program in 2017, OregonSaves became the nation's first state-mandated retirement savings program.

Under Oregon law, all employers are required to facilitate OregonSaves if they don't offer a retirement plan for their employees. The program is facilitated by employers and funded by employee investments. That means that businesses of all sizes, whether they employ hundreds or just one or two individuals, must either enroll their employees in the OregonSaves program or sponsor a qualifying retirement plan.

Virginia

Virginia's state-mandated retirement plan is known as RetirePath Virginia. Under Virginia law, businesses with more than 25 employees, have been operating for two or more years, and does not provide a retirement plan option must to enroll in RetirePath Virginia.

Washington

The Washington Retirement Marketplace is an online portal where businesses with fewer than 100 workers and their employees can compare and enroll in retirement savings plans. The marketplace offers a variety of plans including Traditional Individual Retirement Accounts (IRA), Roth IRA, and Traditional 401(k).

While Washington State does not mandate businesses to offer a retirement plan, it provides the Retirement Marketplace as a resource for those businesses that choose to do so. Therefore, any business in Washington State can choose to use the Retirement Marketplace to facilitate retirement savings for their employees, but they are not required by law to do so.

Choosing Between a State Mandated Retirement Plan or Adopting Your Own

Businesses that operate in a state where retirement plans are mandated will need to decide whether to use the state-run plan or find an independent provider. Often, the best choice for your business will depend on your financial and administrative capabilities, as well as your short- and long-term goals.

State-run plans are inexpensive (they typically do not involve any upfront or set-up costs) and they also have minimal administrative requirements. However, state-run retirement plans can also be very limited in terms of how much they allow employees to save for retirement. Many states, for instance, offer Roth IRA programs. The annual contribution limit associated with this type of account by the IRS is just $7,000 for 2024 ($8,000 if you’re 50 or older). Additionally, there’s a limited number of investment providers available for state run investment plans and the investment funds, which are chosen by the government, may not always be the best options or even the most cost-effective options..

Opting to offer a private 401(k) plan, by comparison, allows for annual contributions of up to $23,000, according to 2024 IRS rules.

Most state-mandated IRA plans also do not allow employer contributions, which can be a drawback to consider. (Massachusetts is the exception to this rule, as it allows Safe Harbor contributions).

Additionally, there are no tax credits available to your business when utilizing a state-mandated retirement plan, but this type of benefit is available when offering a startup 401(k) plan. Eligible businesses may qualify for tax credits for the start-up or administration costs associated with a private, employer-sponsored plan. Read our article about employer tax credits to find out more.

Find the Right Retirement Plan for Your Business

As a business owner, it’s important to understand whether you’re required by state laws to offer a retirement plan for employees. An increasing number of states are implementing such mandates and for good reason. Significant numbers of Americans are vastly underprepared for retirement.

The key question to consider is whether your business and its employees would be best served by a state-run plan or a private retirement plan.

With the right plan and partner, businesses can benefit from improved employee engagement and loyalty while helping them build their retirement savings. Get started today and get a recommendation from our 401(k) retirement specialist.