Find the Right Retirement Plan: Starter 401(k) vs. Safe Harbor 401(k)

At Penelope, we believe that securing a comfortable retirement should be attainable for everyone. That’s why we’ve made it our mission to provide the smallest businesses with affordable and easy-to-set-up retirement plans. A 401(k) is not just a retirement savings vehicle, but a powerful tool that can provide significant tax benefits while helping small business owners attract and retain top talent.

The importance of saving for retirement now cannot be overlooked — saving for retirement isn't a sprint, it's a marathon. The sooner you start, the more time your money has to grow, thanks to the magic of compounding. In this guide, we’ll compare our two current plan offerings: the Starter 401(k) and the Safe Harbor 401(k) so you can find a retirement plan that suits your budget and savings goals.

What is the Difference Between a Starter 401(k) Plan and a Safe Harbor 401(k) Plan?

A Starter 401(k) Plan and a Safe Harbor 401(k) Plan are both types of retirement savings plans offered by employers, but they have several key differences.

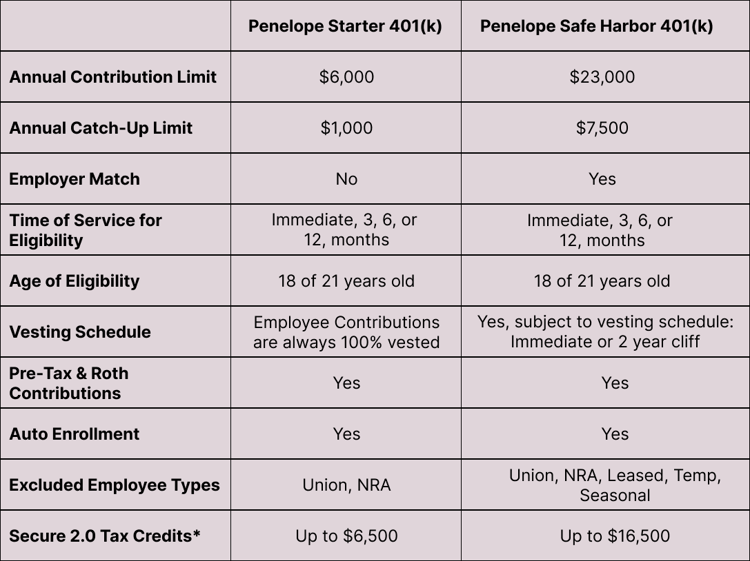

Key Differences Between a Starter 401(k) and a Safe Harbor 401(k) Plan:

- Annual contribution limits

- Annual participant catch-up contribution limits

- Employer matching options

- Automatic enrollment percentages

Starter 401(k) Plan

A Starter 401(k) plan is designed for small businesses that want to offer an employer-sponsored retirement plan but might have a limited budget to do so. This plan allows employees to make pre-tax or Roth contributions, but they can only contribute up to $6,000 in 2024.

If you are over 50 years of age, you can contribute an additional $1,000. Employers are not required to contribute to an employee’s account. Since these plans are exempt from IRS non-discrimination testing, they have fewer compliance requirements compared to traditional 401(k) plans and are simpler to administer.

Definitions:

Pre-tax Contributions: These are deducted from your employee’s salary before taxes are taken out. This means your employees pay less income tax now, but they’ll pay taxes on the money when they withdraw it in retirement.

Roth Contributions: These are made with after-tax dollars. Your employees will pay income tax now, but they can withdraw the money tax-free in retirement, including all the earnings on their contributions.

Safe Harbor 401(k) Plan

With a Safe Harbor 401(k) plan, the employer has to make mandatory contributions to the employee's retirement account. These contributions can either be matching contributions based on the amount the employee contributes or non-elective contributions made on behalf of all eligible employees, regardless of whether they contribute to the plan.

The contribution limit for a Safe Harbor 401(k) in 2024 is $23,000 with an additional contribution of $7,500 for those who are over the age of 50.

Similar to a Starter 401(k) plan, a Safe Harbor 401(k) plan also automatically satisfies the non-discrimination tests required by the IRS, making them easy to set up and administer.

Ideal Scenarios for Each Retirement Plan

Now that we've explored the key differences between these two plans, let's consider the ideal scenarios for each plan. A small business owner might choose a Starter 401(k) plan or a Safe Harbor 401(k) plan based on several factors, including the size of their company, their ability to make mandatory contributions, and their desire to avoid IRS compliance testing.

Starter 401(k) Plan

The Starter 401(k) plan may be more suitable for small businesses that:

- Have a limited budget for retirement benefits but still want to offer an option for their employees

- Are not looking to match employee contributions

- Don't anticipate needing high employee contribution limits

- Are required by their state to offer a retirement plan but are looking for an alternative to the state plans

Safe Harbor 401(k) Plan

The Safe Harbor 401(k) plan may be a better fit for small businesses that:

- Want to ensure compliance with nondiscrimination testing

- Are willing to make mandatory employer contributions

- Have employees who desire higher contribution limits

Penelope 401(k) Retirement Plan Cost Comparison

When it comes to retirement plans, cost is an important consideration. Let's break down the cost of both plans for a small business owner with 20 employees who decides to work with Penelope for their 401(k) retirement needs.

Penelope Starter 401(k) Plan:

- The monthly subscription fee is $49

- The monthly fee per active employee is $3

So, for 20 employees, the monthly fee for all employees would be $3 x 20 (employees) = $60

The total monthly cost for the Starter 401(k) plan would be $49 (subscription fee) + $60 (employee fees) = $109

The annual cost would be $109 (monthly cost) x 12 (months) = $1,308

Penelope Safe Harbor 401(k) Plan:

- The monthly subscription fee is $125

- The monthly fee per active employee is $8

So, for 20 employees, the monthly fee for all employees would be $8 x 20 (employees) = $160

The total monthly cost for the Safe Harbor 401(k) plan would be $125 (subscription fee) + $160 (employee fees) = $285

The annual cost would be $285 (monthly cost) x 12 (months) = $3,420 + the contribution match per employee

Please note that these costs don't include any potential tax benefits that might be available to the employer offering these plans. As a small business, you may qualify for a tax credit that covers 100% of your plan start-up costs and employer match. These tax credits can add up to $16,500 and are available for three years. Always consult with a tax professional for accurate information based on your business.

Ready to Explore Your Retirement Options?

Choosing the right retirement plan for your small business is an important decision. We hope this comparison guide has shed light on the features, pros and cons, ideal scenarios, costs, and tax implications of the Starter 401(k) and Safe Harbor 401(k) plans. Remember, every business is unique, so it's important to consult with a retirement specialist to determine which plan aligns best with your business goals.

If you have questions about setting up a retirement account for your small business, we want to help you! Schedule a complimentary call with our retirement specialist to get started planning for a secure retirement for you and your employees today.